Financial reporting plays a critical role in ensuring transparency, accountability, and trust in global business. As companies expand across borders and investors operate internationally, the need for a common accounting language becomes increasingly important. International Financial Reporting Standards (IFRS) were developed to meet this need by providing a globally accepted framework for preparing financial statements.

Today, IFRS is used in more than 140 jurisdictions, making it one of the most influential accounting standards in the world. This article provides a comprehensive overview of IFRS, including its history, objectives, structure, key standards, benefits, and practical challenges.

What Is IFRS?

International Financial Reporting Standards (IFRS) are a set of accounting standards designed to ensure consistency, transparency, and comparability in financial reporting across countries. IFRS governs how financial statements are prepared and presented, including the recognition, measurement, presentation, and disclosure of financial transactions.

IFRS is developed and issued by the International Accounting Standards Board (IASB), an independent standard-setting body based in London.

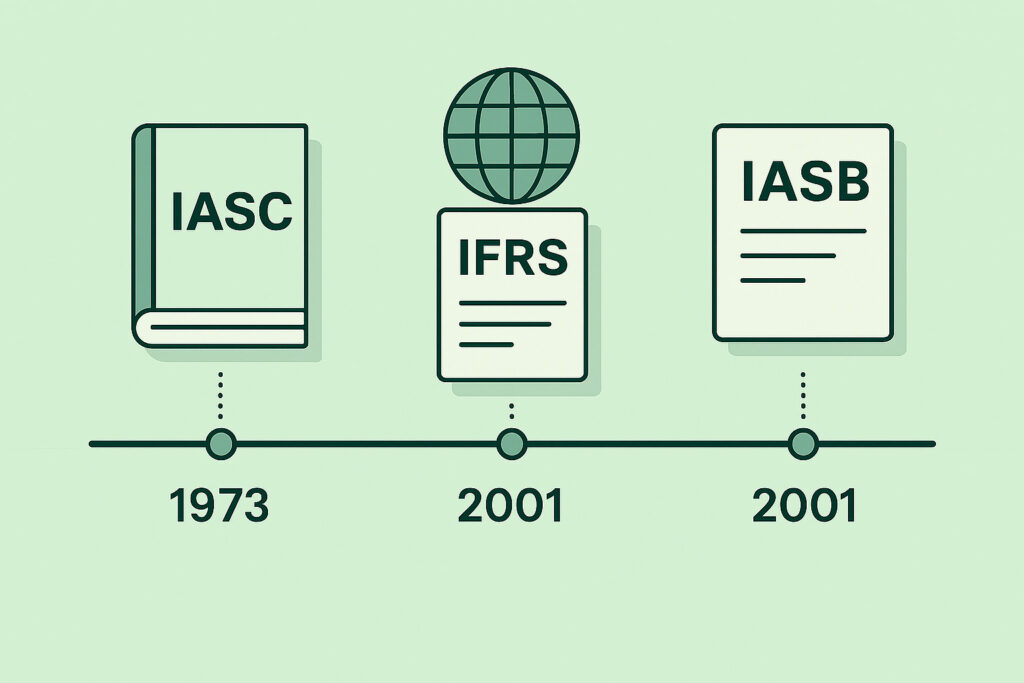

A Brief History of IFRS

Early Development

- 1973: The International Accounting Standards Committee (IASC) was formed to develop global accounting standards.

- 1973–2001: The IASC issued International Accounting Standards (IAS).

Formation of IASB

- 2001: The IASC was restructured into the International Accounting Standards Board (IASB).

- From this point onward, new standards were issued as IFRS, while existing IAS standards continued to apply unless replaced.

Global Adoption

- 2005: The European Union required all listed companies to adopt IFRS.

- Since then, many countries across Asia, Africa, and the Americas have either adopted IFRS fully or aligned local standards closely with it.

Objectives of IFRS

The main objectives of IFRS are to:

- Provide high-quality, transparent, and comparable financial information

- Improve investor confidence and decision-making

- Reduce the cost of capital by improving financial statement reliability

- Promote consistency in global financial reporting

- Support efficient functioning of international capital markets

Who Uses IFRS?

IFRS is commonly used by:

- Publicly listed companies outside the United States

- Multinational corporations

- Financial institutions

- Investors and analysts evaluating cross-border investments

- Subsidiaries of global groups preparing consolidated accounts

Some countries require IFRS for all companies, while others limit its use to listed entities.

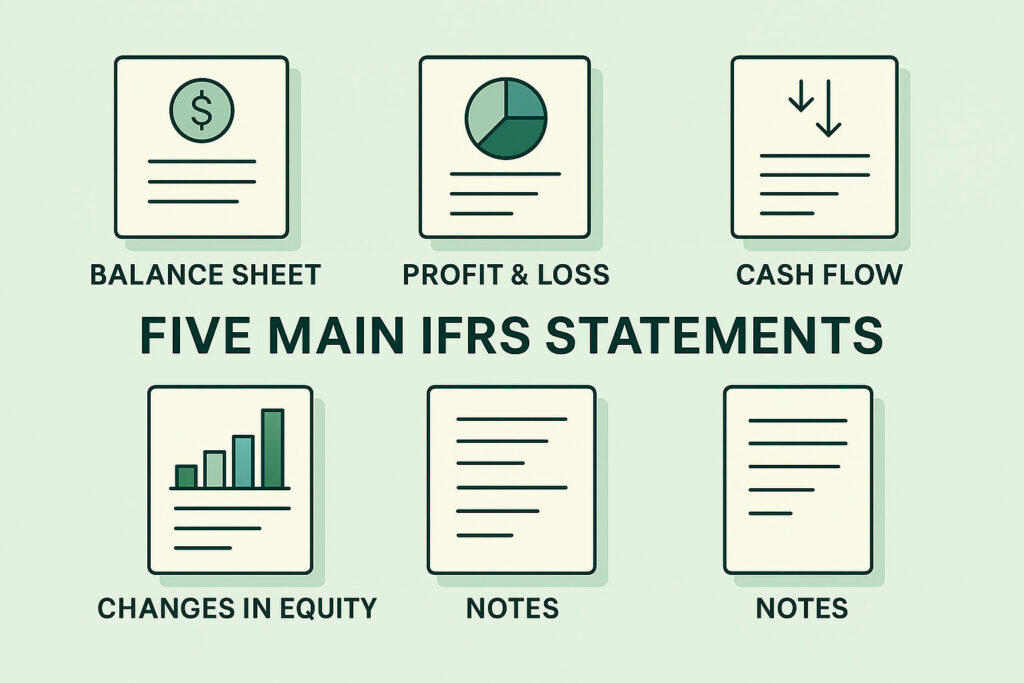

Key Components of IFRS Financial Statements

Under IFRS, a complete set of financial statements typically includes:

- Statement of Financial Position

- Statement of Profit or Loss and Other Comprehensive Income

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes to the Financial Statements

These statements collectively provide a comprehensive view of an entity’s financial performance and position.

Principles-Based Approach of IFRS

IFRS follows a principles-based approach rather than a rules-based one. This means:

- Standards focus on underlying economic substance

- Professional judgment is emphasized

- Less prescriptive guidance compared to some national standards

This approach allows IFRS to be applied flexibly across different industries and jurisdictions.

Major IFRS Standards Explained

IFRS 15 – Revenue from Contracts with Customers

Provides a five-step model for revenue recognition, focusing on performance obligations and transfer of control.

IFRS 16 – Leases

Requires lessees to recognize most leases on the balance sheet, increasing transparency of lease obligations.

IFRS 9 – Financial Instruments

Covers classification, measurement, impairment, and hedge accounting of financial instruments.

IAS 1 – Presentation of Financial Statements

Sets out overall requirements for financial statement presentation and minimum disclosure requirements.

IAS 36 – Impairment of Assets

Ensures assets are not carried at more than their recoverable amounts.

Advantages of IFRS

Global Comparability

Financial statements prepared under IFRS can be compared across borders, improving investor analysis.

Improved Transparency

IFRS emphasizes disclosure and fair presentation of financial information.

Lower Reporting Costs

Multinational companies can use a single accounting framework for group reporting.

Investor Confidence

Consistent reporting enhances trust and credibility in financial markets.

Challenges of IFRS Adoption

Complexity

Some standards, such as financial instruments and leases, are technically complex.

Judgment-Heavy

The principles-based nature requires skilled professionals and strong internal controls.

Transition Costs

Initial adoption can involve system changes, training, and restatement of financial data.

IFRS vs Local Accounting Standards

Many countries maintain local GAAP frameworks that are partially or fully aligned with IFRS. While IFRS promotes global consistency, differences may still exist due to:

- Local legal requirements

- Tax regulations

- Economic environments

Companies often need reconciliation when transitioning between IFRS and local standards.

IFRS and the Future of Financial Reporting

IFRS continues to evolve in response to emerging business models, digital assets, sustainability reporting, and global economic changes. The IASB actively updates standards to reflect modern financial realities, ensuring IFRS remains relevant and reliable.

Conclusion

IFRS has transformed global financial reporting by creating a common accounting language for businesses worldwide. Its principles-based approach, global acceptance, and focus on transparency make it a cornerstone of modern financial reporting.

For companies operating internationally, understanding IFRS is not optional—it is essential for compliance, investor confidence, and long-term success.